The ethanol industry in Thailand has been active since 1961 as one of the Royal Project of His Majesty the King.

Later, as an oil-importing country, Thailand has lost economic growth opportunity and energy security due to limited oil supply and price fluctuation.

The seek for alternative energy for liquid fuel uses for transportation sector has been developed as a part of National Energy Policy and ethanol was then upgraded as national policy in 1995, initially in order to replace a toxic Octane Booster, i.e. Methyl tert-butyl ether (MTBE) in gasoline.

By that time, the consumption rate of gasoline was 20 million liters per day which required 10% Octane Booster or 2 million liter per day; this formula is equivalent to Gasohol E10 (for octane 91 and 95), a blend of unleaded gasoline with 10% v/v anhydrous ethanol.

With a rising concern of Global Warming and Clean Development Mechanism (CDM), gasohol containing higher ethanol components has been currently developed; E20 & E85.

Presently, there are 47 factories legally licensed to produce biofuel ethanol with a total capacity of 12.295 million liters/day or 3,688.5 million liters per annum (at 300 working days).

Two feedstocks, namely sugar cane molasses and cassava are their primary raw materials.

A total of 40 factories use only a single feedstock; 14 factories using molasses with a total production capacity of 2.485 million liters/day, 25 factories using cassava with a total production capacity of 8.590 million liters/ day and 1 factory using sugar cane with a total production capacity of 0.2 million liters/ day.

A multi-feedstock process using both molasses and cassava is, however, preferred in some factories (7 factories with a total production capacity of 1.020 million liters/day) to avoid feedstock shortage (Department of Alternative Energy Development and Efficiency, DEDE, 2009).

A complication of Thai bioethanol industry is generated due to the fact that there are two feedstock types being used in other industries and also other alternative energy for transportation, i.e. LPG (Liquefied petroleum gas) and CNG (Compressed natural gas), being promoted by the government.

Feedstock supply

In Thailand, cassava is considered as one of the most important economic crops with the annual production around 25-30 million tons.

The role of cassava in Thailand is not only as a subsistent cash crop of farmers, but it also serves as an industrial crop for the production of chips and starch, being supplied for food, feed and other products.

This can be indicated by a continuous increase in root production since 2000 and be greater than 20 million tons since 2006.

With the national policy on bioethanol use as liquid fuel, it significantly drives a rise in root demand.

Various scenarios have been proposed to balance root supply and demand, in order to reduce the conflict on food vs. fuel security.

Under the normal circumstance, root surplus should be used for bioethanol production, which initiates another industrial demand of roots and helps stabilize root price for farmers.

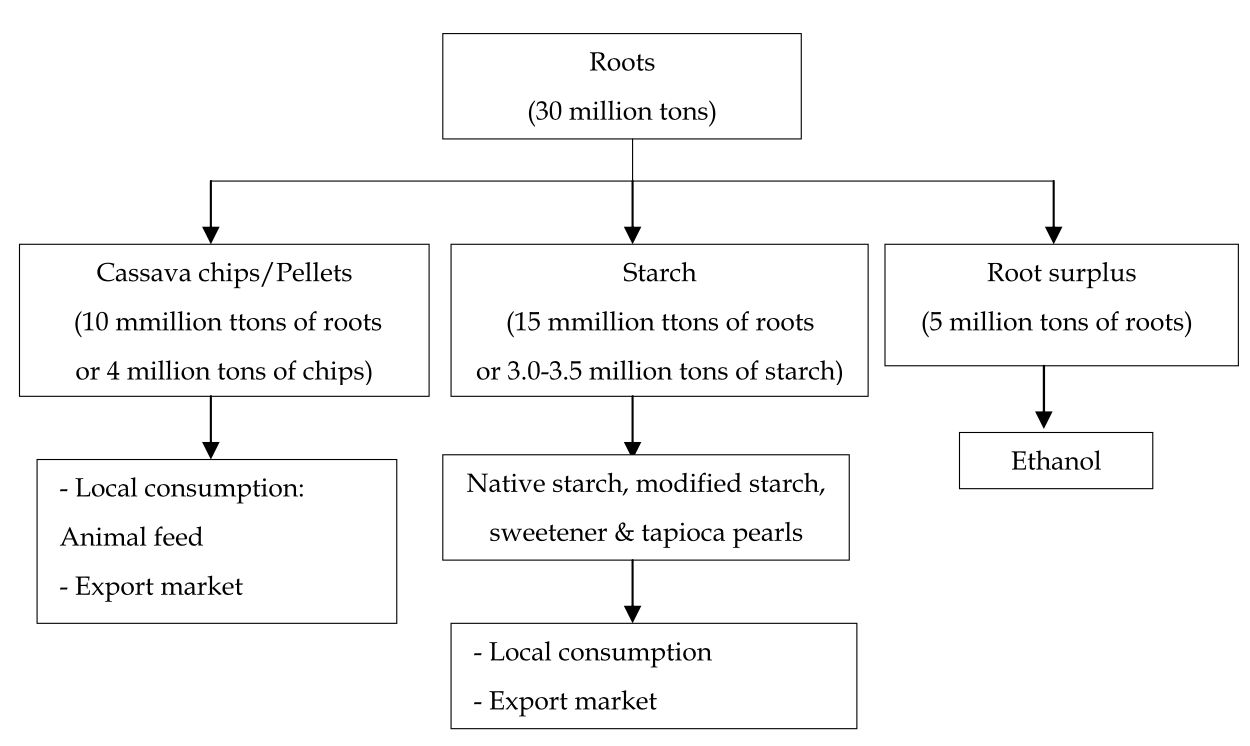

This picture is an example of projecting plan for root consumption by various industries, which corresponds to the targeted root production, proposed by Ministry of Agriculture and current root demand for chip and starch production.

Another scenario is to reduce the amount of exporting chips and allocate those locally to existing industries.

Meanwhile, the campaign for increasing root productivity (ton per unit area) by transferring good farming and agricultural practices has been distributed throughout the countrywide.

In spite of that root shortage occurs in the last few years, caused by unexpected climatic change and widespread disease, i.e. mealy bugs.

This, in fact, critically affects starch industries at a much greater extent than ethanol industry.

Nevertheless, the starch industry is more competitive for higher root prices than ethanol industry.

This situation of an unusual reduction of root supply emphasizes the need of increasing root production.

A short-term policy on increasing root productivity from 25 tons/hectare by good farm management and cultivation practice has continuously pursued and expected to be 50 tons/hectare.

Furthermore, long-term plan on R&D for varietal improvement is also greatly significant in order to develop varieties with higher root productivity (potentially be upto 80 tons/hectare), good disease resistance and good adaptation to climatic change such as higher growing temperatures or very dry condition.

Ethanol demand in biofuel use

Presently, there are 17 factories operating with the total production capacity of 2.575 million liters/day but most of them have operated under their full production capacity due to oversupply of ethanol.

The influencing factor for decreasing ethanol demand is other alternative energy for transportation, i.e. Liquid Petroleum Gas (LPG) and Compressed Natural Gas (CNG), being promoted by the government.

LPG is a primary fuel for household use such as for cooking that is why it is important to control the price of LPG (being low at 18 Baht per kilogram or 0.59 USD per kilogram).

This promotes an increase usage of LPG in automobile sector, as indicated by increasing automobile engine change from gasoline to LPG.

For CNG, there are several policies being released to promote the use of CNG in automobile sector in order to reduce the amount of gasoline consumption.

Firstly, there is an exemption of tax for CNG fuel tank. Secondly, government agrees to cover the cost of changing car engine to CNG-using engine for taxi countrywide and tax reduction for CNG fuel cost.

With the cost of production and fuel itself, the actual price is at 14.75 Baht per kilogram but the selling price is only at 8.50 Baht per kilogram.

This difference requires a significant amount of subsidized oil fund to compensate the gap.

At present, the government led by Ministry of Energy, has considered different mechanisms to intensify ethanol demands in transportation sector by promoting use of gasohol with a higher ethanol component (E85 and E100) for Flexible Fuel Vehicle (FFV), use of ethanol in motorbikes and use of ethanol as diesohol for trucks.

These applications need technical support to acquire consumer’s confidence. In addition, supporting policy and effective mechanism for exporting bioethanol can help expand market demand.

Regulation and pricing

To establish the local market for bioethanol demand in transportation sector, Thailand has released the regulation of denatured ethanol for gasohol uses to ensure high quality fuel for automobile use.

No regulation for biofuel uses is announced by the government. In stead, the utilization of bioethanol as liquid fuel has been promoted by price incentive system.

The retail price of gasohol E10 (for octane 95) is cheaper than gasoline around 0.33 USD/liter by exemption and reduction of excise & municipal tax and Oil Fund charge.

| No. | Description/Details | Value | Analytical method |

| 1 | Ethanol plus higher saturated alcohols, %vol. | 99.0 | EN 2870 Appendix 2 Method B |

| 2 | Higher saturated (C3-C5) mono alcohols, %vol. | < 2.0 | EN 2870 Method III |

| 3 | Methanol, %vol. | < 0.5 | EN 2870 Method III |

| 4 | Solvent washed gum, mg/100 mL | < 5.0 | ASTM D 381 |

| 5 | Water, %wt. | < 0.3 | ASTM E 203 |

| 6 | Inorganic chloride, mg/L | < 20 | ASTM D 512 |

| 7 | Copper, mg/kg | < 0.07 | ASTM D 1688 |

| 8 | Acidity as acetic acid, mg/L | < 30 | ASTM D 1613 |

| 9 | pH | >6.5 and <9.0 | ASTM D 6423 |

| 10 | Electrical conductivity, μS/m | < 500 | ASTM D 1125 |

| 11 | Appearance | Clear liquid, not cloudy, homogenous, and no colloidal particles |

| 12 | Additive (if contains) | Agree with consideration of Department of Energy Business |

At the initial phase of trading ethanol locally, the price of ethanol for domestic market is referred to the price of imported ethanol from Brazil (FOB price of Brazilian Commodity Exchange Sao Paulo) with the additional cost of freight, insurance, loss, survey and currency exchange rate.

Thai cassava ethanol industry has used two feedstock, i.e. molasses and cassava; the former one being utilized at a higher production capacity. This leads to shortage of molasses and price increase.

As a result, the reference price based on Sao Paulo does not reflect the real ethanol situation of the country, both in term of production and uses.

Subsequently, the pricing formula of biofuel ethanol has been revised. The reference price of bioethanol for fuel uses, as approved by The National Energy Policy Committee, Ministry of Energy, has taken into account for the cost of raw materials and produced quantities of fuel ethanol from both feedstocks, i.e. molasses and cassava, using the conversion ratios of 4.17 kg molasses (at 50oBrix) and 2.63 kg cassava chips (with starch content > 65%) for 1L of anhydrous ethanol.

In addition, the structure of ethanol reference prices includes the production costs of each feedstock, which are 6.125 and 7.107 Baht/L for molasses and cassava, respectively.

This monthly-announced ethanol reference price reflects the actual cost of local ethanol producers.

PEth = [(PMol x QMol) + (PCas x QCas)]:QTotal

Where:

- PEth = Monthly reference price of ethanol (Baht/L)

- PMol = Price of molasses-based ethanol (Baht/L)

- PCas = Price of cassava-based ethanol (Baht/L)

- QMol = Quantity of molasses-based ethanol (million L/day)

- QCas = Quantity of cassava-based ethanol (million L/day)

- QTotal = Total ethanol quantity (million L/day)

(For QMol, QCas and QTotal using the value of one month previously, e.g. for the 5th month reference price, use the value of 3th month)

PMol = RMol + CMol

Where:

- PMol = Price of molasses-based ethanol (Baht/L)

- RMol = Raw material cost of molasses, using a previous 3-month average export price announced by the Thai Customs Department and the conversion ratios of 4.17 kg molasses (at 50oBrix) for 1L of anhydrous ethanol, e.g. using the average export price of 1st, 2nd, and 3rd month to calculate the price of 5th month

- CMol = Production cost of molasses-based ethanol (6.125 Baht/L)

PCas = RCas + CCas

Where:

- PCas = Price of cassava-based ethanol (Baht/L)

- RCas = Raw material cost of cassava, using the root price of one month previously, the conversion of 2.38 kg (25% starch) fresh roots for 1kg of chips with the production cost of 300 Baht/ ton chips, and the conversion ratios of 2.63 kg cassava chips (with starch content > 65%) for 1L of anhydrous ethanol

- CCas = Production cost of cassava-based ethanol (7.107 Baht/L)

Conclusion

Cassava is not only a traditional subsistence food crop in many developing countries, it is also considered as an industrial crop, serving as a significant raw material base for a plenitude of processed products.

Important ones are starches, modified starches and sweeteners for application in food, feed, paper, textile, adhesive, cosmetics, pharmaceutical, building and biomaterial.

Consequently, the demand of cassava has been rising continuously and thereby contributes to agricultural transformation and economic growth in developing countries.

Recently, in some countries such as Thailand, China and Vietnam, cassava is also used as the energy crop for producing bioethanol, an environmentally friendly, renewable alternative fuel for automobile uses.

The promise of using cassava for bioethanol use is supported by many reasons including distinct plant agronomic traits for high tolerance to drought and soil infertility, low input requirement relatively to other commercial crop, and potential improvement of root yields.

In addition, roots are rich in starch and contain low impurities. Although, fresh roots contain high moisture contents and are perishable, simple conversion to dried chip can be achieved by farmers at a low cost.

Chips as corn analog are less costly to transport, store and process.

High energy input for ethanol production from starch materials become less concerned as low energy consumption processes are developed including SSF, SLSF for uncooked process and VHG for a higher ethanol concentration.

Improved waste treatment and utilization is also significant in order to minimize overall production cost.

With those development, the use of cassava as an energy crop raises more concerns for food and fuel security.

Both are critical to agricultural countries that mainly import fossil oil fuel and have lost their economic growth.

To overcome that concern, the development of sufficient feedstock supply is considered as the first priority.

A short-term and long term plans for root yield and productivity improvement by good cultivation practice and varietal improvement have been presently implemented in some regions.

By that with a combination of zero-waste process concept, effective policies and market mechanism, the use of cassava as a food crop, industrial crop and energy crop become sustainable and beneficial to mankind.