According to the Import-Export Department of the Ministry of Industry and Trade, Vietnam holds the impressive position of being the world’s third-largest exporter of cassava and cassava products in terms of volume, following Thailand and Cambodia. Additionally, Vietnam ranks second in export turnover, trailing only Thailand in this aspect.

Introduction

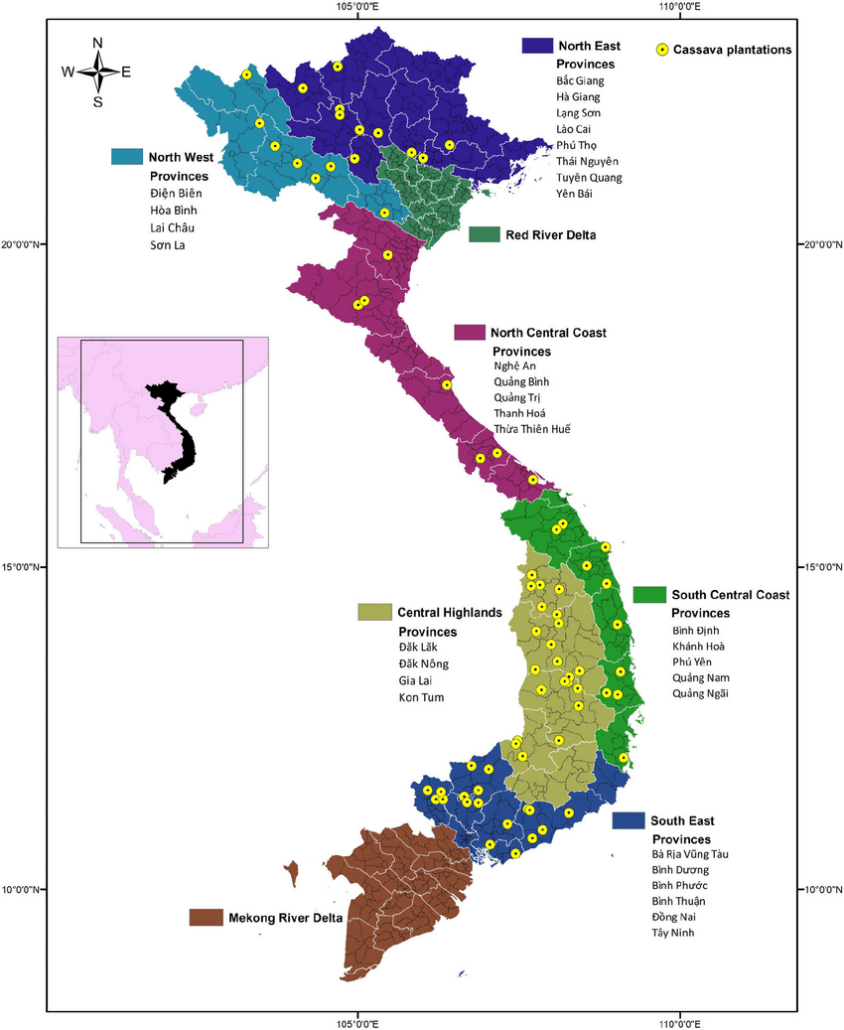

In 2021, Vietnam witnessed a significant expansion of its cassava cultivation, spanning approximately 528,000 hectares. This growth was primarily concentrated in five key regions: the Northern Midlands and Mountains, the North Central Coast, the South Central Coast, the Central Highlands, and the Southeast. The country’s total cassava production is estimated to have reached nearly 10.7 million tons, with an average yield of 20.3 tons per hectare.

Vietnam boasts 27 provinces and cities housing cassava starch processing factories, including approximately 120 industrial-scale facilities. These factories have a combined design capacity of 11.3 million tons of fresh tubers per year, although their actual capacity stands at 8.62 million tons annually.

According to the Department of Crop Production, cassava and its derived products are among Vietnam’s 13 key agricultural exports, generating an annual export turnover of 1.35 billion USD. This positions Vietnam as the world’s second-largest exporter in this sector, following Thailand.

Cassava Cultivation in Vietnam: Regional Distribution and Key Insights

Cassava cultivation areas in Vietnam are distributed across seven agro-ecological regions, with the majority concentrated in five key regions. These five regions collectively account for approximately 97% of the country’s cassava cultivation, encompassing an area of about 483 thousand hectares and yielding 8,330 thousand tons. This output represents 98% of the country’s total cassava production.

Among these regions, the North Central Coast, Central Coast, and Central Highlands exhibit the highest concentration of cassava cultivation. The North Central Coast and Central Coast regions alone account for 31% and 27% of the country’s total cassava area, respectively, with corresponding yields of 2,607 thousand tons (31%) and 2,180 thousand tons (26%).

The Southeast region ranks fourth in terms of cassava cultivation area among the five major regions, but it boasts the highest productivity nationwide, averaging 25.3 tons per hectare. In 2010, its total cassava production reached 2.28 million tons, accounting for 27% of the country’s total output. The Central Highlands experienced the highest growth rate in cassava cultivation area during the ten-year period from 2001 to 2010, with an annual increase of 14%. The North Central Coast and Central Coast regions followed closely with the highest growth rates, averaging 6% per year. The provinces with the largest cassava acreage in the country are currently Gia Lai (63.4 thousand hectares), Tay Ninh (45.7 thousand hectares), Kon Tum (41.7 thousand hectares), and Dak Lak (31.8 thousand hectares), in descending order.

Cassava Growing Seasons in Vietnam: Regional Variations and Harvest Timings

Cassava cultivation in Vietnam is influenced by diverse natural conditions across different ecological regions. As a result, the ideal cassava growing seasons vary across these regions.

In the northern provinces, cassava is typically planted between February and March, with harvesting taking place from December to January of the following year.

In the North Central region, cassava planting commences in January.

The South Central region allows for earlier planting, from January to March, with harvests occurring in September or October before the onset of the rainy season.

In the Central Highlands, Southeast, and certain highland areas of the Mekong Delta, cassava is primarily grown at the transition from the dry season to the rainy season (April-May). These regions experience consistent high temperatures and regular rainfall during this period.

In some areas, cassava cultivation may continue until June or July. In active water regions of the Mekong Delta, cassava is often planted at the beginning of the year to ensure harvesting before the flood season. The specific growing seasons vary according to local conditions, but generally, cassava can be harvested 8-10 months after planting. For cassava intended for flour production, the harvesting period usually extends to 10-12 months. Alternatively, sweet cassava varieties grown for immediate consumption can be harvested within 6-9 months.

Vietnam’s Cassava Products

Vietnam has achieved significant mastery in the production and processing of cassava and tapioca starch, encompassing both natural and modified varieties. The country offers a range of key cassava products, which include:

Tapioca Chips

Tapioca chips, the simplest form of tapioca processing, undergo a straightforward production process. Once tapioca roots are harvested, they are shredded into small pieces and dried on a pad. These dried tapioca chips serve as raw material for the animal feed industry, animal production, or the tapioca pellet industry. Notably, Vietnam holds the distinction of being the leading supplier of tapioca chips to China, cementing its strong position in the market.

Native Tapioca Starch

Native tapioca starch refers to the unmodified starch derived from the cassava plant. It is extracted from the cassava roots through a process that involves washing, crushing, and separating the starch from other components. Native tapioca starch is commonly used as a thickening agent, stabilizer, or binder in various food and industrial applications. It has a neutral flavor, high viscosity, and excellent clarity when dissolved in water.

Vietnam’s native tapioca starch, renowned for its high quality, serves as the primary export product. It finds substantial markets in countries such as China, Japan, Korea, Malaysia, the United States, and various European nations. The increasing exports reflect its compliance with stringent food processing standards.

Modified Starch

Vietnam has developed the expertise to produce top-quality modified tapioca starch that meets both American standards (INS) and European standards (E-number). With the implementation of the Vietnam-European Free Trade Agreement (EVFTA), cassava starch exports to the European market have witnessed consistent growth.

Vietnam’s modified starch products include E1420 (Acetylated Starch), E1404 (Oxidized Starch), E1412 (Distarch Phosphate), E1413 (Phosphated Distarch Phosphate), E1414 (Acetylated Distarch Phosphate), E1422 (Acetylated Distarch Adipate) , E1450 (Starch Sodium Octenyl Succinate), E1451 (Acetylated Oxidized Starch).

Cationic Starch

Cationic starch is a commonly employed wet-end additive in the paper industry, serving to enhance paper strength, fines retention, and drainage. It plays a vital role in improving paper quality by promoting stronger fiber-to-fiber bonding and reducing porosity.

Vietnam’s Cationic Starch products enjoy significant popularity among paper manufacturers from Korea, Japan, and China. Notably, these countries constitute Vietnam’s primary export market for Cationic Starch.

Export Performance of Vietnam’s Cassava Products and Market Trends in 2022

Between January and November 2022, Vietnam witnessed notable growth in the export of cassava and cassava products, amounting to nearly 2.86 million tons valued at 1.25 billion USD. This marked a 9.5% increase in volume and a 17.6% increase in value compared to the same period in 2021. The key products exported were tapioca starch and dried cassava chips.

Specifically, Vietnam exported 2.18 million tons of tapioca starch valued at 1.05 billion USD during this period, reflecting an 18.4% increase in volume and a 21.6% increase in value compared to the same period in 2021. The primary destinations for these exports were China, Taiwan, the Philippines, Korea, and Indonesia. Notably, China remained the largest market for Vietnam’s cassava starch consumption, accounting for 94.47% of the country’s total exports with 2.06 million tons valued at $987.08 million. This represented a 16.8% increase in volume and a 19.4% increase in value compared to the same period in 2021.

Furthermore, Vietnam exported 693.63 thousand tons of dried cassava chips valued at US$203.17 million during the first 11 months of 2022. Although there was an 11.1% decrease in volume, the value increased by 0.5% compared to the same period in 2021. These dried cassava chips were primarily exported to China, Korea, Malaysia, and Papua New Guinea. China remained the largest market for Vietnam’s dried cassava chips, accounting for 78.25% of the country’s total exports with 542.77 thousand tons valued at $152.02 million. However, there was a 21.5% decrease in volume and a 12% decrease in value compared to the same period in 2021. Notably, exports of cassava chips to China experienced a sharp decline, while exports to Korea saw a significant increase during this 11-month period in 2022.

Vietnam Cassava Association

The Vietnam Cassava Association was formed under the guidance of the Vietnamese government with the aim of fostering collaboration and providing support to farmers and businesses involved in the cassava industry. Its primary objective is to facilitate trade opportunities between Vietnam and countries across the globe.

Location: No. 3, Alley 479, Hoang Quoc Viet Street, Cau Giay, Hanoi

Frequently Asked Questions When Dealing with Vietnamese Cassava Suppliers

Product Specifications: The specifications of the product provide important information such as starch content, moisture level, pH, viscosity, and more. These details help you gain a better understanding of the product and to know if it meets your standard requirements.

Package Size: What package size are you looking for? Tapioca starch is typically available in 25kg, 50kg, or 850kg jumbo bags, or in larger quantities like 17 metric tons for a 20″ container.

Intended Use of Tapioca Starch: What is the specific purpose for which you are purchasing tapioca starch? Are you using it in the food industry or non-food industry? This information helps suppliers meet your specific needs.

Payment Terms: For initial purchases, it is common to require 100% payment in advance. However, for subsequent orders, there may be flexibility to pay 50% in advance and the remaining 50% via a letter of credit (L/C).

Shipment Preferences: Please provide your shipment preferences. Do you prefer FOB (Free on Board) terms or would you like CIF (Cost, Insurance, and Freight) or CFR (Cost and Freight) to a specific port?

The EU-Vietnam Free Trade Agreement (EVFTA)

The EU-Vietnam Free Trade Agreement (EVFTA) is a comprehensive trade agreement between the European Union (EU) and the Socialist Republic of Vietnam, aimed at strengthening their bilateral relations. In addition to the EVFTA, the EU-Vietnam Investment Protection Agreement (EVIPA), a bilateral investment treaty, was also agreed upon.

The EVFTA was adopted through Council Decision (EU) 2020/753 on March 30, 2020, marking a significant milestone in Vietnam-EU relations. It was subsequently ratified by the Vietnamese National Assembly on June 8, 2020, and officially came into effect on August 1 of the same year. The approval of both agreements in Vietnam received overwhelming support, with approximately 95% of lawmakers voting in favor.

As per the European Commission, these agreements aim to enhance trade, boost job creation, and foster economic growth for both parties. The key benefits include:

- Tariff elimination for 99% of all traded goods

- Reduction of regulatory barriers and streamlining of bureaucratic processes

- Safeguarding geographical indications to protect unique regional products

- Opening up service and public procurement markets

- Establishing enforceable rules and regulations

Regarding native tapioca starch, a duty-free quota of approximately 30,000 tonnes has been agreed upon under the EVFTA.

These agreements demonstrate the commitment of both the EU and Vietnam to fostering closer economic ties, promoting trade liberalization, and creating a favorable business environment for businesses in both regions.

Considerations when Importing Tapioca Starch from Vietnam

Vietnam holds the position of being the second largest global producer and exporter of tapioca starch, highlighting its prominence as a reliable and significant supplier in the international market.

Nevertheless, it is essential to exercise caution when procuring goods, conducting thorough supplier research, and exploring various options to make informed comparisons. If your intention is to establish long-term cooperation, it is advisable to visit the factory of your prospective supplier before finalizing any purchase agreements. By doing so, you can ensure transparency and assess the production facilities firsthand, strengthening your confidence in the partnership.