Cassava, known scientifically as Manihot esculenta Crantz, has undergone a remarkable transformation in India. Introduced by the Portuguese in the 17th century as a food crop, it has evolved into a vital industrial raw material. This shift from sustenance to industry, particularly in Tamil Nadu and Andhra Pradesh, has not only reshaped its role but also generated employment opportunities in rural India.

Cassava’s Changing Role

Cassava, scientifically known as Manihot esculenta Crantz, was introduced to India by the Portuguese during the 17th century as a food crop. Over time, it has evolved into an industrial raw material. Initially valued for its role as a food source, especially in Kerala during times of famine, cassava has gradually shifted towards industrial use, particularly in Tamil Nadu and Andhra Pradesh, where it is used for starch extraction. This transformation has generated rural employment in Tamil Nadu due to the growing starch and sago industries.

Current Cassava Production in India

Approximately 13% of Asian cassava production is in India. Production trends in India over the past four decades show that while cassava area and production increased steadily from 1963 to 1977, they declined afterward. However, overall production has been maintained at about 5.5 million tonnes thanks to a remarkable increase in yield, from 7 t/ha in 1963 to 24 t/ha in 2000. This high yield in India (compared to the world average of 10 t/ha) is mainly attributed to the introduction of high-yielding cassava varieties and improved production practices.

Challenges and Strategies

Several challenges hinder further cassava yield improvement in India, including a low multiplication rate, bulky planting material requirements, rapid stake drying, and diseases like cassava mosaic disease (CMD) and root rot. To address these issues, innovative approaches are being pursued:

- True Cassava Seed Program (TCSP): This program aims to overcome the low multiplication rate and bulkiness of planting material by increasing seed propagation rates 150-fold, ensuring longer seed viability, and preventing the transmission of mosaic virus through seeds.

- Cassava Mosaic Disease Management: Efforts to manage CMD include producing disease-free materials through meristem culture, multiplying planting material in vector-free zones, and involving farmers in mass multiplication of healthy planting materials.

- Breeding Strategies: In industrial zones like Tamil Nadu and Andhra Pradesh, breeding focuses on developing high-starch varieties with CMD tolerance, early harvestability, and better post-harvest storage life.

- Agronomic Interventions: These include developing low-input and mycorrhizal technologies, optimizing natural resource use, and improving water management.

- Variety Testing and Popularization: Outreach programs such as the Lab-to-Land Program (LLP), Institution-Village Linkage Program (IVLP), and on-farm trials (OFT) aim to enhance cassava production by testing and promoting suitable cassava varieties.

Regional Shifts in Cassava Production

While cassava is cultivated in about 13 Indian states, major production occurs in Kerala and Tamil Nadu. Over the past 30 years, the area under cassava in Kerala has decreased due to changing lifestyles, the influence of remittances from Indians working abroad, and shifts to cash crops like rubber. In contrast, Tamil Nadu has seen significant growth in cassava production due to cheap labor and organized marketing channels. This shift is evident in the changing contributions of the two states to national cassava production.

Future Prospects

Considering population growth and demand, India needs to produce up to 12 million tonnes of cassava roots by 2020. With the current productivity of 22.5 t/ha, projections indicate potential increases to 26.95 t/ha by 2000, 32.57 t/ha by 2010, and 38.20 t/ha by 2020. To achieve this, research and development strategies must address the challenges and opportunities in cassava cultivation.

In conclusion, cassava cultivation in India has evolved from a food crop to an industrial raw material, with significant regional variations in production. Innovative strategies and research programs are crucial to sustain high yields, overcome biological constraints, and support cassava’s role in India’s agricultural landscape.

Exports

In 2021, India became a noteworthy exporter of tapioca starch, selling a total of $4.14 million worth. This made India the 12th largest global exporter of tapioca starch, showing its strong presence in the world market. Tapioca starch is just one of many products India exports.

The United States was the main buyer of India’s tapioca starch, importing a significant amount valued at $1.67 million. The United Arab Emirates and Malaysia also purchased considerable quantities, worth $523,000 and $515,000, respectively. Nepal and South Africa were notable importers as well, buying $411,000 and $403,000 worth of tapioca starch from India.

Between 2020 and 2021, India’s tapioca starch exports saw impressive growth. The United States increased its imports from India by $1.4 million. The United Arab Emirates and Malaysia also showed significant growth, with additional imports of $503,000 and $473,000, respectively.

Imports

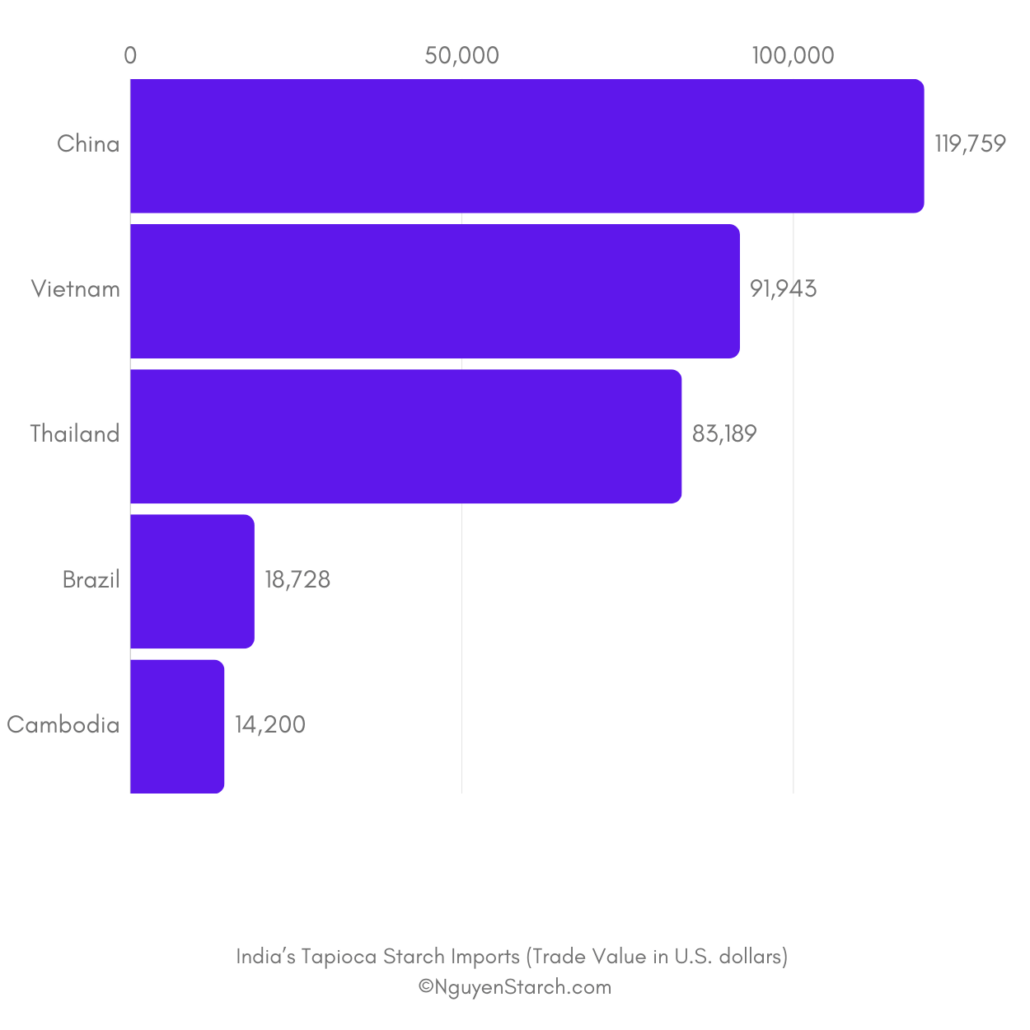

In 2021, India ranked as the 67th largest global importer of tapioca starch, with imports totaling $340,000. Tapioca starch is not a major imported product for India, and it ranked quite low among the items India imports. China was the primary source of India’s tapioca starch imports, accounting for $120,000. Vietnam and Thailand followed, contributing $91,900 and $83,200 worth of tapioca starch, respectively. Brazil and Cambodia were also notable suppliers, providing $18,700 and $14,200 worth of the product, respectively.

Between 2020 and 2021, India’s tapioca starch imports saw notable growth. China, the leading supplier, increased its tapioca starch exports to India by $120,000. Singapore also saw progress, with an additional $7,390 worth of tapioca starch imports. Brazil contributed to this growth with an increase of $2,290.